2023

April 27, 2023

Notice of Posting of an Impairment Loss and a Revision of Business Forecast

Kurita Water Industries Ltd. (hereinafter "Kurita") announces that a meeting of the Board of Directors held today resolved to revise the business forecast for the fiscal year ended March 31, 2023 (April 1, 2022 to March 31, 2023) announced on October 31, 2022. Details are as follows.

1. Posting of an impairment loss

Kurita will post a goodwill impairment loss of 7.6 billion yen in the fiscal year ended March 31, 2023, related to the Water Treatment Chemicals business of Kurita America, Inc., a consolidated subsidiary that operates the Water Treatment Chemicals business and the Water Treatment Facilities business in the United States. Kurita performs an impairment test each year and every time that there are any signs of an impairment and calculated the goodwill impairment loss at Kurita America, Inc. (Water Treatment Chemicals business) by comparing the use value and accounting book value. The use value is calculated by discounting the expected future cash flows using an appropriate discount rate. In the United States, the discount rate used in the calculation of the use value rose to 10.8% in the fiscal year under review (9.5% a year earlier), due to policy interest rate hikes to curb inflation. Kurita estimated future cash flows of Kurita America carefully and revised them downward, considering changes in the water treatment chemicals market in the United States following the outbreak of COVID-19 and results in the fiscal year under review, which were affected by disruptions to logistics and rising prices, as well as results in previous fiscal years. As a result, the use value was less than the accounting book value, and Kurita recognizes an impairment loss.

2. Revision of the business forecast and its reason

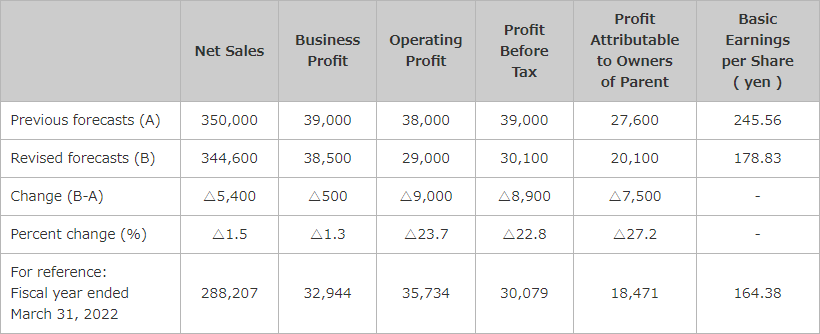

- (1)Revision of the consolidated business forecast for the fiscal year ended March 31, 2023

(April 1, 2022 - March 31, 2023)

(Million yen)

| Net Sales | Business Profit |

Operating Profit |

Profit Before Tax |

Profit Attributable to Owners of Parent |

Basic Earnings per Share ( yen ) |

|

|---|---|---|---|---|---|---|

| Previous forecasts (A) | 350,000 | 39,000 | 38,000 | 39,000 | 27,600 | 245.56 |

| Revised forecasts (B) | 344,600 | 38,500 | 29,000 | 30,100 | 20,100 | 178.83 |

| Change (B-A) | △5,400 | △500 | △9,000 | △8,900 | △7,500 | - |

| Percent change (%) | △1.5 | △1.3 | △23.7 | △22.8 | △27.2 | - |

| For reference: Fiscal year ended March 31, 2022 |

288,207 | 32,944 | 35,734 | 30,079 | 18,471 | 164.38 |

- Note)Business profit is the Group’s own indicator that measures constant business performance. It is net sales less cost of sales and selling, general and administrative expenses. Although business profit is not defined by IFRS, the Group voluntarily discloses it, believing that it is beneficial for users of its financial statements.

- (2)Reason of the revision

In the fiscal year ended March 31, 2023, net sales are expected to fall short of the forecast, particularly in the domestic and overseas precision tool cleaning business. Along with this reason, business profit will be below the forecast. Operating profit and other profit figures below it will also be less than the forecasts, mainly reflecting the goodwill impairment loss described in "1. Posting of an impairment loss."

The dividend forecast remains unchanged.

- Note)These forecasts are based on our company's judgment based on currently available information and may differ from actual results due to changes in various factors.